Investment Strategy

small- and shallow-bay Industrial

Capturing Value Up and Down the Risk Spectrum

Development

Build-to-core projects targeting value-add to opportunistic returns.

Value-Add

Leveraging our operator mindset and vertical integration to unlock value.

Core+

Infill sub-institutional assets focused on long-term income and growth.

Opportunistic

Acquiring debt and distressed assets to capitalize on dislocation.

APPROACH

What Makes us different

01.

Pure Industrial Focus

We exclusively aggregate light last-mile industrial assets. These properties are located in the most densely populated submarkets, are limited in supply, have high barriers to entry, are extremely difficult to build, and are the bulk of the leasing demand.

02.

Data-Informed Market Selection

Through our in-house, real-time “Market Tracker” tool, we’re able to translate historical market-level data into potential absorption, rent growth and industrial growth, giving us actionable insights into which (sub)markets offer the strongest long-term value based on the best opportunities for economic growth and compelling supply/demand real estate fundaments.

03.

Vertical Integration

As investors and operators, we can add value from acquisition through sale as our in-house resources and expertise allows us to address needs and create value in ways our competitors can’t.

04.

Nimble Approach to Investment strategy

While we know the assets we like, we constantly evaluate and re-evaluate how we can acquire these assets – whether it be through development or acquisition of value-add or core-plus properties – while delivering the best risk-adjusted returns. We believe if the market fundamentally changes, so should our strategy.

05.

Partnerships built on trust

We aim to provide institutional quality investments with the transparency, humility, and relationship service of a small firm. Our team is directly invested in Rectangle’s continued success.

our focus

target assets

PRIMED FOR WHAT'S NEXT

Data-Driven investment manager

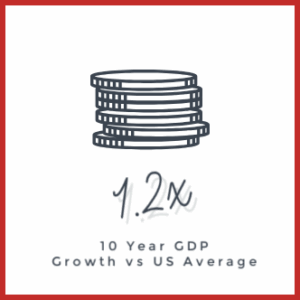

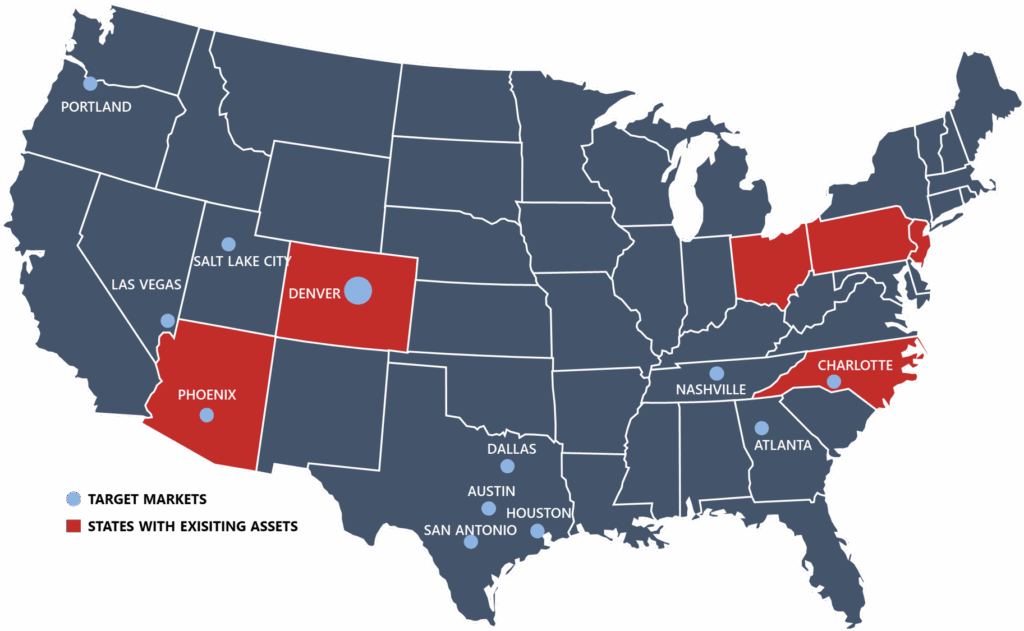

Rectangle’s data-driven approach is dedicated to investing in high growth markets most likely to continue outpacing other top-75 industrial metro areas – taking into account economic, demographic, and real estate specific data points from more than 30 sources.

Rectangle developed an in-house, real-time market evaluation tool (Market Tracker) used to identify and target markets best poised for industrial growth balanced with fundamentals.

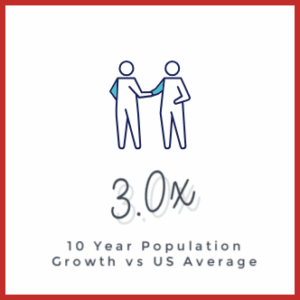

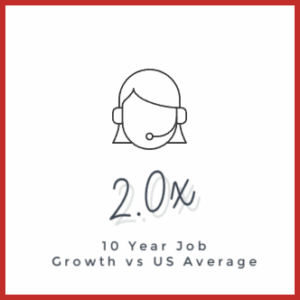

Our Target Markets Greatly Outpace the US